We received 5.318425 BTC as rewards.

Payout in STX and BTC

We introduced a distribution flow in BTC on individual requests. The BTC rewards were split proportionally.

For cycle 91, we used

1.18171076 BTC for BTC distribution and

-

4.13671423 BTC for STX distribution.

Dust transactions

There are many dust rewards of 200 sats. We ignore these utxos because consolidating them is more expensive then their value. That means that a few sats will rest in the pox reward address. For this cycle, there were 59,800 sats left in the wallet after reward distribution. This is something to keep in mind when doing accounting.

Liquid Stacking With LISA

This cycle, the Liquid Stacking service LISA with FAST Pool as part of Lisa’s backend delegated 1,640,000 STX to Fast Pool. Lisa used 4 smart contract as pool members. The share of Lisa was 4.088038% of the STX part of the pool.

The rewards were distributed with the normal distribution flow:

-

6,034.838138 STX: https://explorer.hiro.so/txid/0x708eabaf6051f4d8918f487c05d64f2f4f9527b465c2c03f4a56794e730d263b?chain=mainnet

We encourage pool members to check out the documentation and learn more about liquid stacking at https://docs.lisalab.io/

Consolidation and Swapping

At the end of the cycle, we consolidated the rewards in 3 transactions because there were too many reward inputs to fit into a single consolidation transactions. Therefore, we split it in two. Then we consolidated the remaining inputs after the end of the cycle. We distributed 1.12262522 BTC to 1 pool member who registered for BTC rewards and 0.05908553 BTC to the Fast Pool reserve. The remaining 4.13671423 BTC were swapped to 152,187.48964 STX and 147,621.86495 STX were distributed to 682 pool members.

-

2.08067900 to proxy: https://mempool.space/tx/e7b66f0acc63199e8c0e7fe8c96787f4a7e116456e8efe58802f2af7c8ccf836

-

2.96636385 to proxy: https://mempool.space/tx/6c71e89ad48dc936c9f8c79a3370a63a981a99666b724a6930caa3d5bf1d0f1f

-

0.25660292 to proxy: https://mempool.space/tx/b536683e4be301531193e7167194bb187ebb9d665725ad07ddea056fc44a607b

-

1.12262522 to btc reward receivers, 0.05908553 to Fast Pool reserve: https://mempool.space/tx/e6bf98c6442f59692e7f9b01c7bf6382366ff08b28b5e9949ecb9aa0d123e30c

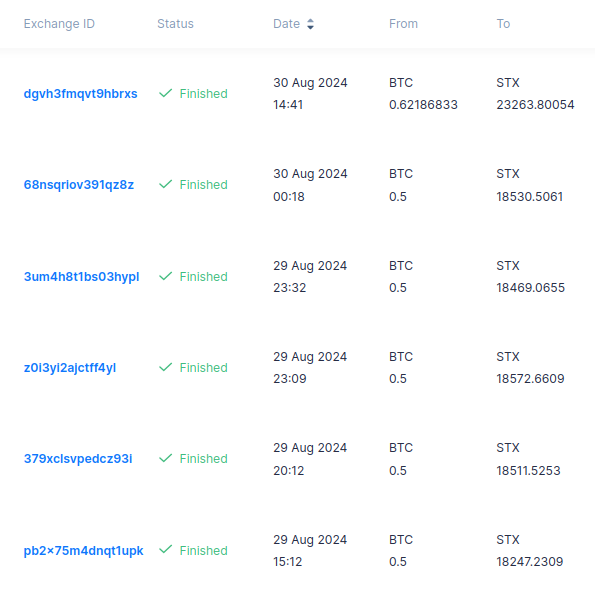

- 0.5 BTC swapped to 18,067.6037 STX:

- 0.5 BTC swapped to 18,247.2309 STX:

- 0.5 BTC swapped to 18,511.5253 STX:

- 0.5 BTC swapped to 18,525.0967 STX:

- 0.5 BTC swapped to 18,572.6609 STX:

- 0.5 BTC swapped to 18,469.0655 STX:

- 0.5 BTC swapped to 18,530.5061 STX:

- 0.62186833 BTC swapped to 23,263.80054 STX:

Total Rewards

A total of 147,621.86495 STX were distributed to 677 pool members and 5 contracts. The distribution was based on 40,117,042.559387 STX stacked to receive STX rewards.

A total of 1.12262522 BTC were distributed to 1 pool member from the proxy btc address. The distribution was based on 11,459,999 STX stacked to receive BTC rewards.

If all BTC rewards were distributed as STX rewards the total would have been 189,792.132666 STX based on 51,577,041.559387 STX stacked.

Preparing for Nakamoto Release (3.5% reserve)

This year, the Nakamoto hard fork will bring sBTC. This means that we will wrap BTC to sBTC, then exchange to STX and distribute.

However, stackers need to do more work eventually, run stacks and a signer node. We successfully started to be signer for Stacks 2.5 and are registered since cycle #84 as signer. We voted during cycle #90 for an initially simplified implementation of block signing.

For cycle #91, we transferred 4,565.624689 STX from STX distribution and 0.05908553 BTC from BTC distribution to the reserve (see above). That is a around than 3.5% of the theoretical total STX rewards after converting BTC to STX at the exchange rate of 2718 sats/stx (4,13,671,423 sats / 152,187.48964 STX).

Swapping using simpleswap

Swapping using simpleswap is not as transparent as using aBTC via Xlink bridge. Therefore, here is a screenshot with the exchange ids. Two swaps are missing because one was done via the simpleswap api (ejv3q9mojldsb6tr) and one accidentially as an anonymous user: